Need to Know Tax Dates for 2026

Running a business means lots of tax deadlines to keep up with. Missing key dates can lead to penalties and unnecessary stress. Read our guide to see the most important deadlines for your business in 2026!

Bonuses, gifts, and charity … oh my!

It’s that time of year when business owners want to reward their employees, thank their clients, and make some personal charitable donations to help reduce their tax liability and spread some cheer.

It’s important to be mindful of IRS rules and regulations when celebrating the holidays with bonuses, gifts, or donations! That has been the focus of my live videos in December, and I wanted to share similar information on my blog.

The OBBB and what it means for you

The One Big Beautiful Bill is more than 1,000 pages long of complicated and in-depth tax changes that are in effect for at least the next few years.

This entire month, I’ve been focused on educating people through my Wednesdays with Wendy about the bill, and, more importantly, what it could mean for them. I’m going to be quick to clarify that nothing I say in this blog should be taken as tax advice for your situation. You need to consult with a licensed tax preparer about your individual tax situation. After all, like many laws, the effects of the OBBB are different for each person!

The biggest changes that I’m covering are:

No tax on tips,

No tax on overtime, and

Changes to SALT.

What you need to know about tax-deductible business expenses

One of the first questions a small business owner usually has is “what business expenses are deductible on my taxes?” If you’re looking for an exhaustive list of deductible expenses, I’m sorry to say, but there isn’t one. What is deductible in one industry or business isn’t necessarily deductible in another business. However, the IRS has given us some guidelines as to what is deductible and tips on how to document that.

Ready to find out more? Let’s dive in!

Don’t lose your dream by ignoring your books

When we, as entrepreneurs, start a business, we aren't usually thinking about the mechanics of running it. We usually go into business because we see a need and want to help others

In my business, I’ve started thinking of September as the start of the new year because school is starting again, most vacations are over, and people are ready to get back to business for the fourth quarter.

No matter what kind of business you operate, you need to keep track of your bookkeeping. It isn’t enough to simply not co-mingle your personal and business funds (which you should never do!). I tell people that whether or not their business thrives or dives depends largely on how much they pay attention to proper bookkeeping.

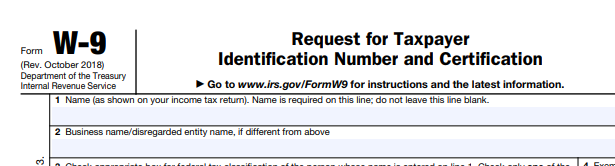

Form W-9: What Business Owners Need to Know

When it comes to managing your business and working with the IRS, you’ve probably noticed that a lot of forms are involved. For businesses that hire contractors, the Form W-9 is important to understand.

QuickBook Tips You Need to Know

All through July, I’ve written and talked about QuickBooks, especially for those of you who manage your own books. DIY Bookkeeping doesn’t have to be tricky, but there is a learning curve.

Let’s review my tips from my Wednesdays with Wendy segments on Facebook! Following these tips will help you optimize your business throughout the entire year.

Doing your own bookkeeping in QuickBooks?

Throughout the month of June, I've been sharing information for those of you who do your own bookkeeping, especially those who use QuickBooks. I get a lot of questions about QuickBooks and how to best manage it on your own!

Before you get too discouraged, remember that none of us is born knowing this information. Managing your own bookkeeping has a steep learning curve, and it's a special skill you must learn, even if we're looking at basic reports.

Let’s take a look at two of the most common problems I see when people are managing their own QuickBooks.

Avoiding Burnout as an Entrepreneur

A few years ago, I wrote about the emotional side of being an entrepreneur and focused mostly on overcoming impostor syndrome.

Throughout May, which is Mental Health Awareness Month, I’ve focused on different aspects of managing mental health as an entrepreneur in my Wednesdays with Wendy Facebook Lives. I also mentioned burnout in my latest newsletter.

Dealing with and even preventing burnout is so important not only for our mental health, but for the health of our families and businesses. That’s why I’m using today’s blog space to talk about it more in-depth.

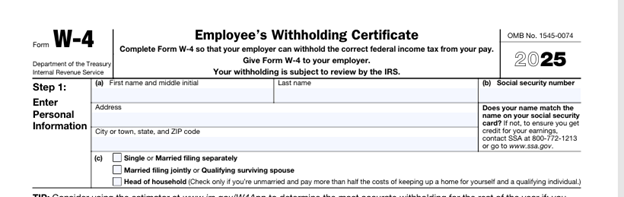

Guide to Filling Out the W4

Were you happy with how your tax return turned out this year? If you weren’t, read on to find out how to adjust your income tax withholding so that next year can be better!

First, you need to know that there are two ways to pay your federal income tax.

Estimated tax payments

Withholding via payroll that shows up on your W2 at year-end

Estimated tax payments are a topic for another time, but today, I want to talk about how to complete the W4 to your best advantage while still fulfilling your financial obligations to the IRS.

QuickBooks Online for Tax Prep

Expenses that are Not Tax Deductible

I’ve mentioned many times how to know which business expenses are deductible. You can refer to this IRS guide. You can also remember these two words: ordinary and necessary. For an expense to be tax deductible, it must be an expense incurred in the ordinary course of business and necessary to achieve your business goal.

This month, I wanted to mention several expenses that many think are tax deductible but aren’t.

Should You File Your Own Taxes?

I get a lot of questions about whether or not you should complete and file your own taxes, especially this time of year. I could talk about this for hours, but I wanted to give you a quick, updated guide to answering this question for yourself.

Bookkeeping seems so easy. Why can’t I do it myself?

Back in 2021, I had the experience of a lifetime! My husband and I flew on a private jet to a beach house in the Caribbean. It was through his (now former) job, so that was the first, only, and probably last time I would ever fly in a private plane. While we were flying, my husband got to sit in the copilot seat and watch the pilot fly the plane. He told me that, other than takeoff and landing, it was actually easy. Once in the air, they just have to hold the controls and keep it straight. Takeoff, landing, and when you hit turbulence are when you’re going to wish you had someone in your corner who knows how to manage the controls.

The same is true for managing your business's financial records.

An update on the BOI

Last week, I went live on Facebook to share an important topic. In the last couple of months, I’ve talked a lot about the Corporate Transparency Act and the Business Ownership Interest (BOI) reporting deadline. The deadline was Jan. 1, 2025.

Until now.

The tale of two business myths

I recently saw a post in a Facebook group I’m in about starting a business and the author said, “We’re not yet generating enough revenue to form an LLC.”

Last year, while speaking with someone who had just started their business, they told me they “didn’t make enough to report it on my taxes.” Aye yi yi!

So, this month, let’s discuss how to know if you have a business, when to report it on your taxes, and why this can be a tricky subject.

Your Year-end Checklist for 2024

It may not even be Halloween yet, but it’s already time to start thinking about your year-end financials and tax preparations for 2024. The better prepared you are, the easier it will be for your bookkeeper and tax preparer to do their jobs.

Here is the general checklist I give clients, whether they are self-employed or an S-Corp.

Selling. Sales. Marketing.

Ugh. I have never been a salesperson. When I was in the first grade, my elementary school sent us door to door to sell jars of spices. The salesperson for the fundraising company had made a presentation to the entire school. We were to tell people we were selling “cry-proof onions” (dried onions) and other such cheeky claims. I thought it was stupid. My little brother, on the other hand, loved it! We’d set out together, and at each house, he’d trot out a cute little soliloquy that caused the people to smile and laugh and say, “Sure! I’ll take two! Oh, and one from your sister,” as I stood off to the side with a scowl on my face that would cause the devil himself to recoil in horror.

Yeah, selling and me never really got along. Fast forward to 2016, when I started my own business. Obviously, now I was going to have to sell my services. How was I going to do that?

Here are three philosophies on selling that helped me turn the tide and embrace it!

How to turn your sales around and win more customers

I’m no stranger to discussing numbers on the blog, but they usually involve the expenses side of a business. This month, I want to discuss the other side of the equation—the revenue side.

People start a business for many different reasons. Those reasons often involve serving an underserved population or providing products that people need. The entrepreneur’s reasons are usually bigger than just making a profit.

However, if your business continually spends more money than it takes in, it won’t be a business for long. In order to be successful in business, you have to provide a product or service that people want.

Tax estimates from your tax preparer: What they are and what to do about them

Once a tax return is finished, the software that was used to prepare the return will look at the amount of income you had, the amount of tax you paid, and whether you owed or got a refund. Then, it will make a recommendation based on how last year went. If you owed taxes in April, or if you didn’t have enough tax withheld through your paycheck, the software will print out “estimates.” These are amounts of tax that you need to pay in each quarter in order to not owe taxes next April. If you make these estimated payments on time, and if your financial situation is roughly the same as last year’s, you will probably not owe additional taxes next April.

That’s why they are called “estimates.”